How to Remain on Top of Deadlines When Submitting an Online Tax Return in Australia

How to Remain on Top of Deadlines When Submitting an Online Tax Return in Australia

Blog Article

Step-by-Step Guide to Finishing Your Online Income Tax Return in Australia

Browsing the on-line tax obligation return process in Australia calls for an organized approach to ensure conformity and make the most of prospective reimbursements. It's vital to recognize the complexities of the tax obligation system and gather all relevant documents, consisting of revenue declarations and deduction invoices.

Understand the Tax Obligation System

In Australia, the tax obligation year runs from July 1 to June 30, and individuals generally lodge their returns in between July 1 and October 31. The Australian Tax Office (ATO) is the governing body in charge of tax obligation management, guaranteeing compliance and giving guidance to taxpayers. Tax obligation prices are progressive, meaning that higher revenue earners pay a greater percent of their revenue in tax obligations.

Comprehending the tax obligation offsets and reductions available is necessary, as they can substantially impact your taxed income. Usual reductions include work-related expenses and charitable donations. Furthermore, it is vital to be knowledgeable about crucial dates and changes to tax obligation regulation that may influence your return. By understanding the basics of the tax obligation system, you can make enlightened decisions when completing your on the internet income tax return.

Gather Required Files

Having a strong understanding of the tax obligation system lays the groundwork for a successful on-line tax return procedure. One of the vital steps in this journey is gathering the required papers. This makes sure that you have accurate details to finish your tax obligation return effectively.

Begin by accumulating your income statements, such as your PAYG recap from your employer, which information your revenues and tax obligation kept. If you are self-employed, prepare your earnings and loss declarations. In addition, gather any bank declarations mirroring rate of interest earnings and returns statements from your investments.

Following, compile your deductions. online tax return in Australia. This might consist of invoices for job-related expenditures, philanthropic donations, and medical expenditures. If you possess a home, ensure you have records of rental income and associated expenditures, consisting of fixings and upkeep prices

Likewise, don't forget to include any type of other appropriate documents, such as your Medicare card, which may be necessary for sure cases. Completing this step meticulously will not only conserve time yet also aid in optimizing your potential refund or decreasing your tax obligation. With all files in hand, you will certainly be well-prepared to continue to the next stage of your on-line tax return process.

Pick an Online Platform

Selecting the best online system is an important action in the tax obligation return procedure, as it can substantially influence your experience and the accuracy of your submission. With numerous options readily available, it's important to think about a number of factors to ensure you select a system that satisfies your demands.

First, examine the platform's track record and user testimonials. Search for solutions that are reputable and have favorable comments regarding their reliability and convenience of usage. Additionally, make sure that the system is signed up with the Australian Taxation Workplace (ATO), as this warranties compliance with lawful needs.

Following, take into consideration the attributes supplied by the system. Some platforms give easy-to-follow guidelines, while others might provide innovative tools for more complex tax obligation scenarios. Opt for a system that provides particularly to your monetary situation. online tax return in Australia. if you have multiple income resources or deductions.

Last but not least, analyze the prices related to each system. While some offer free solutions, others may bill fees based on the intricacy of your return. Consider the prices against the functions provided to make an educated choice that fits your budget and needs.

Full Your Income Tax Return

Finishing your tax return is a critical step that needs mindful interest to detail to guarantee precise coverage and conformity with Australian tax legislations. Begin by gathering all required documents, including your income statements, receipts for reductions, and any other relevant financial documents. This fundamental step is essential for a exact and detailed income tax return.

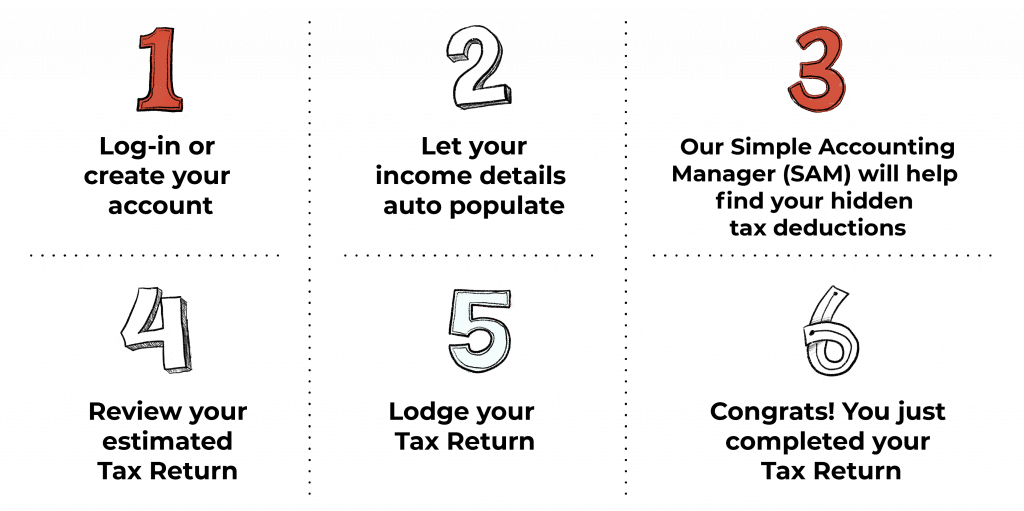

Following, log into your chosen online system and browse to the income tax return section. Input your personal info, including your Tax obligation Data Number (TFN), and confirm your residency standing. When going into revenue details, ensure that you classify it appropriately, such as salary, earnings, or investments.

For reductions, be meticulous in noting all qualified expenditures, such as job-related expenses, donations, and clinical expenses. The on the internet platform commonly provides prompts and suggestions to help you in identifying prospective reductions.

Additionally, put in the time to review any pre-filled details offered by the ATO, as this might include details from your company or financial organizations. Precision in this phase is essential, as blunders can cause penalties or hold-ups. After extensively entering your info, you are currently planned for the next step: reviewing and settling your return.

Testimonial and Submit Your Return

The evaluation and submission phase of your tax obligation return is critical for guaranteeing that your economic info is certified and precise with Australian tax obligation policies. Before settling your return, put in the time to completely examine all entrances. Ascertain your revenue sources, deductions, and any kind of offsets you are claiming to ensure they line up with the documentation you have gathered.

It is suggested to contrast your reported figures against your earnings statements, such as the PAYG recaps from companies or bank rate of interest statements. Pay specific interest to any type of inconsistencies, as also minor mistakes can bring about considerable issues with the Australian Taxation find this Workplace (ATO) Make sure all figures go to the website are gone into appropriately, as incorrect or omitted details can postpone handling or result in charges.

Conclusion

Finishing an on the internet tax return in Australia requires an organized technique to make certain accuracy and compliance. By recognizing the tax system, celebration called for files, choosing a trusted online platform, and carefully completing the tax return, individuals can navigate the procedure effectively.

To efficiently browse the on-line tax return process in Australia, it is important to initially recognize the underlying tax system. By realizing the fundamentals of the tax system, you can make educated decisions when completing your on the internet tax obligation return.

Having a strong understanding of the tax system lays the groundwork for a successful on the see here now internet tax return procedure.Finishing your tax return is a crucial action that needs mindful interest to information to make sure precise reporting and conformity with Australian tax obligation legislations. By comprehending the tax obligation system, celebration called for papers, picking a trustworthy online system, and diligently completing the tax return, individuals can browse the process successfully.

Report this page